HOME→What is the resource tax rate of kaolin mining materials What is the resource tax rate of kaolin mining materials What is the resource tax rate of kaolin mining materials

What is the resource tax rate of kaolin mining materials What is the resource tax rate of kaolin mining materials What is the resource tax rate of kaolin mining materials

Mining Taxes Summary Tool PwC

2024年2月16日 The tax mining tool compares mining tax and royalty rates applying to key commodities in 29 different countries, as well as providing an overview of the core mining tax rules in those countries2024年9月17日 According to the Resource Tax Law, the basic resource tax rates for certain mineral resources are as follows: crude oil: 6% of gross sales; natural gas: 6% of gross sales;Mining Laws and Regulations Report 2025 ChinaThe IGF Mining Tax Incentives Database provides the most granular view yet of tax competition in mining, showcasing how common tax incentives are in the sector Our research compares the Tax Incentives Intergovernmental Forum2014年6月1日 Kaolin is used in many consumer products and as a functional additive and process enabler in manufacturing It is typically extracted from openpit mines that range from Mining and Processing Kaolin Elements GeoScienceWorld

Economic and environmental influences of resource tax: Firmlevel

2022年8月1日 Overall, a 1% increase in resource tax increases mining firm's total factor productivity by 01280% and decreases its carbon intensity by 00167% The conclusion Raw Materials Group, 2011, p 6) Consequently, mineralrich countries now increasingly depend on taxation, not ownership interest, to generate income from their resource wealth The design THE FUTURE OF RESOURCE TAXATION: A ROADMAPThese trends raise the importance of mining for its mineral and financial outputs In this context, governments will need new and innovative fiscal measures to protect the public’s economic The Future of Resource Taxation Intergovernmental Forum2018年12月1日 Since April 1 of 2011, the adjusted resource tax rate on RE has been 60 CNY per ton for light RE, including bastnaesite and monazite ore, and 30 CNY per ton for heavy Resource tax on rare earths in China: Policy evolution and market

Resourcerich countries need to get their mining tax systems right

2021年8月3日 My answer, based on several decades of assisting governments and working alongside highly experienced economists, tax officials and investors, is yesNavigating the tax landscape of mining claim ownership is as challenging as it is necessary By dissecting these five subtopics, claim owners can arm themselves with the knowledge needed to make informed decisions, comply with tax laws, and maximize their financial outcomes in the world of mining Capital Gains TaxWhat are the tax implications of owning a mining claim?2021年10月1日 Previous studies showed that the kaolin mining waste can become a good pozzolan, after adequate treatment and presents good performance when used to produce building materials such as concrete and Valorization of kaolin mining waste from the Amazon2014年6月1日 Discussed herein are aspects of the history of kaolin mining, the classification of kaolin mines, the processing of kaolin, and the life cycle of mining You do not have access to this content, please speak to your institutional administrator if you feel you should have accessMining and Processing Kaolin Elements GeoScienceWorld

.jpg)

Kaolin New Georgia Encyclopedia

2003年12月12日 Kaolin in Georgia is generally found in a northeast to southwest band of deposits extending from Augusta to Macon to ColumbusThis belt parallels the fall line, which marks the boundary between the Piedmont and the Coastal PlainDeposits are of three types: (1) “soft” kaolin, which breaks easily and is soapy in texture; (2) “hard” kaolin, which is more finely 2023年1月12日 Kaolin is an important nonmetallic mineral resource with abundant domestic reserves After beneficiation and processing, kaolin can realize its application value and is widely used in ceramics, paper making, rubber, refractory materials, chemical industry and so on This article introduces the properties, applications and processing methods of kaolin in detail, which Introduction: What is Kaolin Processing and How Does It Work?2022年9月1日 When t q u a n t i t y P > t p r i c e, which is to say when the actual resource tax rate under the ADV tax system is lower than that under the specific tax system, the values of K 2 ∗ K 1 ∗, L 2 ∗ L 1 ∗, and Q 2 ∗ Q 1 ∗ are greater than 1, indicating that resource exploitation enterprises will increase factor input and output after adjustment of the form of resource tax The impact of resource taxation on resource curse: Evidence from considering increases to the mining tax rate and going beyond rates previously established by the Mining Investment Law Australia enacted the Mineral Resource Rent Tax effective beginning on 1 July , 2012 The Australian Minerals Resource Rent Tax applies to bulk commodity projects for coal and iron ore operations, excluding small minersCorporate income taxes, mining royalties and other mining taxes

Effective taxation of the mining sector Taxdev

2021年6月14日 Recent research by the International Centre for Tax and Development suggests that compared to oil and gas, mining is vastly undertaxed In aggregate, African governments collect about 3 percent pf the total value of mining production in tax revenue, compared to 55 percent of the total value of oil and gas production (Moore et al, 2018)A wellconstructed mining tax regime will balance these competing interests, and turn potential adversaries into partners A typical lifeofmine is 1525 years or more, and will outlive several changes of government A mining tax regime should therefore encourage continuing mining investment over the longer term, for it is the continuity inTaxing the mining sector Zambia Chamber of Mines2019年10月31日 Background: This article examines features of the tax systems of 19 African countries with material mining operations Objectives: An interpretive approach is used to explore the implications of a A review of mining taxes in Africa: Tax burden, the strength of 2023年5月26日 Mining taxes and royalties paid to a province or territory for mineral resource income are fully deductible when calculating income for federal income tax Capital cost allowances Most capital assets bought by mining and Tax incentives for mining and exploration Canada

The impact of kaolin mining activities on bacterial diversity and

2024年9月9日 nonkaolin mining area; CKDvi, Dodonaea viscosa rhizosphere soil from nonkaolin mining area; contr ol, bulk soil from nonkaolin mining area Gao et al 103389/fmicb2024 Frontiers in %PDF16 %âãÏÓ 9949 0 obj > endobj 9964 0 obj >/Encrypt 9950 0 R/Filter/FlateDecode/ID[C73CF496A93EB08B4AAC75F48>A477A97843A5BDBE>]/Index KPMG2024年9月8日 Introduction Kaolin is a nonmetallic mineral that is a kind of clay and clay rock mainly composed of kaolinite group clay minerals (Kumar and Lingfa, 2020; Hu et al, 2023)Kaolin has excellent physical and chemical properties, such as malleability and fire resistance, and is widely used in papermaking, ceramics, and refractory materials (Menezes et Frontiers The impact of kaolin mining activities on bacterial 2024年10月24日 Rare earth mining in Vietnam was at the top of the agenda when the President of the United States was in Vietnam back in September 2023 Keen to reduce its dependence on China for these unique metals, the US has been looking for alternative suppliers, and with what is estimated to be the thirdlargest rare earth reserve in the world, Vietnam has emerged as one Vietnam’s Natural Resource Tax 2024

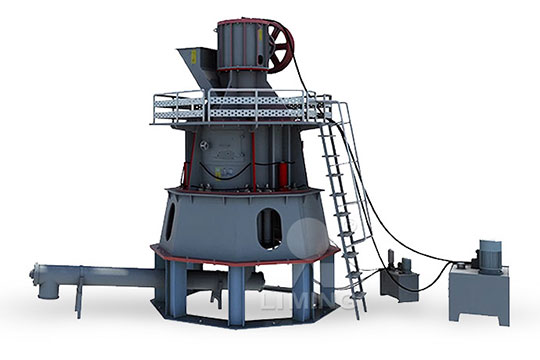

Kaolin Mining Process Explained miningpedia

In order to increase the mining recovery rate and ensure the safe production of the mine, in actual mining, you need to fully explore the mine and select the appropriate mining method and technology for mining based on the mine resource analysis report If you have any ideas about kaolin mining or want to learn more about kaolin, environmental eects of rare earth resource tax (Ge and Lei 2018), water resource tax (Ouyang et al 2022), and iron ore resource tax (Jiang et al 2020) based on CGE models In addition, a small body of studies empirically examined the impact of resource tax For example, Ji et al (2021) measured the implementation eciency of resource taxWhat is the role of resource tax in sustainable development? A mining, was identified as one of the key sectors that could help revive the economy at the time In 1986 the Minerals and Mining Law (PNDC Law 153) was enacted to promote and regulate the orderly development of the sector The SmallScale Gold Mining Law (PNDC Law 218), the Mercury Law (PNDC LawMINERALS AND MINING POLICY OF GHANA2023年10月8日 The low tax rate and the tax basis are main problems of the China’s rare e arth resource tax 221 The Low Tax Rate Not to Reflect the Scarcity of the Rare Earth ResourcesAnalysis of China's Rare Earth Resources Tax ResearchGate

.jpg)

Using kaolin mining waste to produce sustainable building materials

2023年9月18日 Request PDF Using kaolin mining waste to produce sustainable building materials The construction industry is responsible for 36% of global energy use and almost 40% of global greenhouse gas 2012年8月1日 The need to change coal resource tax base and increase tax rate has been discussed for years The low tax rate and volumebased tax base failed to reflect the real value of natural resources and Resource Tax Reform: A Case Study of Coal from the Perspective 2015年12月1日 A calcined kaolin mining waste (CKW) from Pará (Brazil) was used as an aluminosilicate precursor The dried kaolin mining waste was calcinated in a static oven at 750 • C for one hour and Valorisation of a kaolin mining waste for the production of geopolymers PDF On Dec 1, 2019, Lyman Mlambo published The Performance of the Zimbabwe Mining Sector in 2019 Find, read and cite all the research you need on ResearchGate Article PDF Available The The Performance of the Zimbabwe Mining Sector in

.jpg)

Mineral Royalties Tax – GRA

Minerals and mining operations Tax (Mineral Royalty) is imposed on income of a person engaged in mineral operations Subject to any fiscal stability agreement, the mineral royalty rate is 5% of the total revenue earned from mining operations and is calculated for each year of assessment2023年11月19日 The Global Market for Kaolin The demand for kaolin on the global market is substantial, with a steady increase attributed to its diverse applications Key players in the kaolin industry are actively involved in mining, processing, and distributing this valuable mineral Challenges and Controversies Surrounding Kaolinwhat can kaolin be used for: Applications Across Industries2021年9月29日 New Taxes Will Impede the Success of American Mining The Natural Resources Budget Reconciliation Act proposes additional fees including an eight percent gross royalty on new mining operations, a four percent gross royalty on existing operations and a seven centperton tax on dirt, rock and other materials moved during the extraction processNew Taxes and Fees Will Set Back US Mining2023年10月19日 Mining is the process of extracting useful materials from the earth Some examples of substances that are mined include coal, gold, or iron oreIron ore is the material from which the metal iron is produced The process of mining dates back to prehistoric times Prehistoric people first mined flint, which was ideal for tools and weapons since it breaks into Mining Education National Geographic Society

industrial uses of kaolin: Applications and Benefits

2023年10月1日 Kaolin in Plastics Reinforcing Thermoplastics Kaolin is added to thermoplastics to enhance their mechanical properties, making them stiffer and more impactresistant Flame Retardant Properties In some plastic applications, kaolin acts as a flame retardant, reducing the risk of fire Kaolin in Construction Materials Concrete AdditiveThe global kaolin market size is further expected to grow at a CAGR of 42% in the forecast period of 20242032, reaching about USD 650 billion by 2032Kaolin Market Analysis Size, Trend Industry Report 年5月27日 As per scoping study, total cumulative cashflows generated over the LOM are projected to be A$2,222M pretax and A$1,642M post tax At an assumed discount rate of 8%, the White Cloud Kaolin Project is expected to have an NPV of A$705M pretax and A$533M posttax The IRR is expected to be 113% pretax and 108% posttaxSuvo delivers White Cloud Kaolin Project scoping study Mining2017年8月1日 According to HSN Code 2516 calcareous building stone comes under 5% tax rate, but simultaneously under HSN Code 6802 it comes under 28% tax rate Clarity on the same may be provided by the Government Answer: 50 FAQs on GST on Mining Sector in India Tax Guru

.jpg)

Mineral Royalty leaflet

a) Holders of the following mining rights and licenses are liable to mineral royalty on minerals produced under their respective licenses: • Large scale mining license , • Large scale gemstone license, • Smallscale mining license, • Smallscale gemstone license, • Artisan’s mining right, and • Mineral trading permit2023年1月12日 The term kaolin is typically used for clayey material that is low in iron content and is white or nearly white and composed of minerals of the kaolin group The kaolinforming clays are all hydrous aluminium silicates, essentially Kaolin Resources VictoriaTYPES OF KAOLIN : There are several types of kaolin, each with its own unique properties and uses The most common types of kaolin are: 1 Kaolinite: This is the most common type of kaolin and is available in a wide range of colors, including white, yellow, pink, and redKaolin mining techniques rotary core, auger drilling methodsThe rate of tax is 25 percent of the gross amount of the payment (no deductions permitted) Nonresidents of Canada who reside in a country with which Canada has a tax treaty may be entitled to relief from Canadian income or withholding tax, as tax treaties take precedence over the ITA For example, Canadian tax treaties generally lower the rate Canadian Taxation of Mining

Rare Earth Elements: A Resource Constraint of the Energy Transition

2021年5月18日 Other possibilities for reducing the environmental impact of REE mining involve improving the technology and processes being used in existing mining efforts, including finding ways to maximize recovery of REEs from mined material, upgrade recycling routes of ewaste and tailings to decrease waste disposal, and improve tailing treatment and pond Target for mining: Alluvial: Hard rock: Area for mining lease: Such size as reasonably required for the mine: Such size as reasonably required for the mine: Requirement for EIA: Areas more than 250 hectares: Areas more than 250 hectares: Duration of mining lease: Estimated life of the ore body to be mined or 21 years whichever is shorterInformation – Malaysian MineralsOf these, weathered Hiltaba Suite granite in the Great White area, 15 km southwest of Poochera, has returned the highest quality kaolin, with a resource of 174 Mt of “bright white” kaolin identified, and total resource of kaolinised granite of 346 Mt (November 2020)Kaolin Energy Mining2 CHALLENGES AND GUIDELINES OF MINING TAX POLICY This section of the guide explains some of the issues that mining tax policy makers should be aware of, and some guidelines on designing a tax regime 21 Challenges involved in the taxation of the mining industryA guide to mining taxation in Zambia

.jpg)

Kaolin Mining Market Trends: Key Insights

2024年3月6日 Our recent report forecasts that the Kaolin Mining Market size is projected to reach approximately USD XXX billion by 2031, up from USD XXX billion in 2023 This growth is expected to occur at a